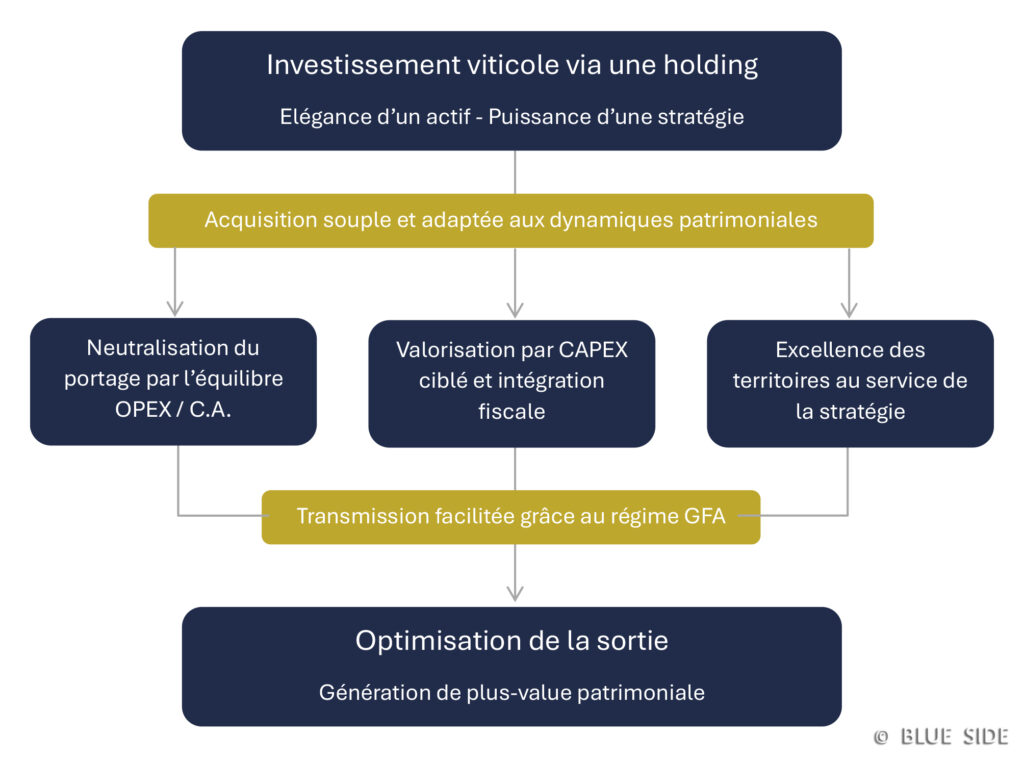

Combining passion, heritage, and performance: this is the promise of a structured wine investment through a holding company. This type of transaction is part of a comprehensive approach, encompassing wealth, tax, and emotional aspects.

A flexible acquisition, adapted to the dynamics of the estate

Acquiring an equity stake in a wine estate can be achieved through several configurations:

— by leveraging the holding company's excess cash,

- through structured financing,

- or as an extension of acontribution-cessionThis enables the proceeds of the sale to be optimally reused in a tangible, meaningful asset.

1. Neutralization of carrying costs through OPEX / sales balance.

From the outset, the aim of balancing operating costs and sales is to secure detention of the estate. This financial stability is the foundation of serene and efficient management.

2. Valuation through tax consolidation and targeted CAPEX

Asset performance is based on the ability to reinvest the tax savings generated by tax consolidation, in the form of intelligently allocated CAPEX. This mechanism transforms the tax advantage into consolidated wealth, anchored in the value of land and infrastructure.

3. Optimizing exit: creating added value

The enrichment of assets over the course of the holding period opens the way to a controlled exitgenerating a net capital gainin an anticipated and prepared tax framework.

3 bis. GFA regime makes it easier to pass on

The eventual integration of wine-growing land into a Groupement Foncier Agricole (GFA) offers additional leverage:

- a lean transmissionthanks to specific tax allowances on the value of the shares,

- and a perpetuating assets as part of a harmonized family or estate plan.

4. The excellence of terroirs at the service of strategy

The success of this operation is based on the choice of wine-growing and wine-tourism areas. with high potential for added value and desirability.

Blue Side deploys its niche expertise, combining in-depth knowledge of terroirs, economic analysis and tailor-made support for demanding investors.

Examples of opportunities for this type of investment: